At the end of the month, the total expenses recorded in the “Advertising Expenses” account will be calculated by summing up the debit column. In this example, the “Advertising Expenses” account tracks the various advertising expenditures incurred by the company in May 2023. Each expense is recorded as a debit entry in the account, increasing its balance. Income and expenses are closed to a temporary clearing account, usually Income Summary. Afterwards, withdrawal or dividend accounts are also closed to the capital account.

Escapia: Best for Robust Accounting & Reporting Tools

- The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019.

- When you close the books monthly, that means you make journal entries to ensure all transactions for the month have been captured.

- You can report retained earnings either on your balance sheet or income statement.

- Debiting this account results in an increase in the account’s balance.

- When an expense account is debited, an expense transaction or an expense increase is recorded in the account.

- At the end of the year, all the temporary accounts must be closed or reset, so the beginning of the following year will have a clean balance to start with.

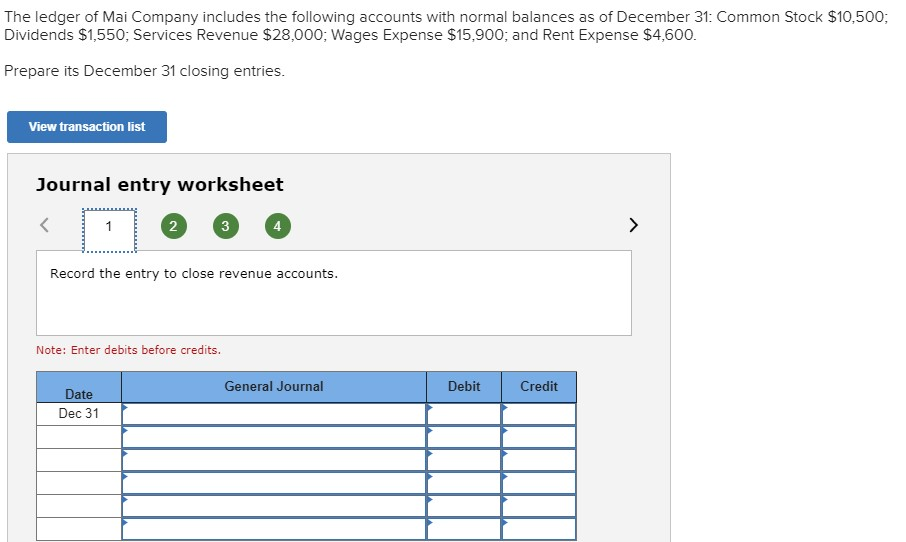

If you don’t have accounting software, you must manually create closing entries each accounting period. Why was income summary not used in the dividends closing entry? Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary. This time period, called the accounting period, usually reflects one fiscal year. However, your business is also free to handle closing entries monthly, quarterly, or every six months. Sum up the preliminary ending balances from the last step to make a trial balance.

Four Steps to Complete Closing Entries

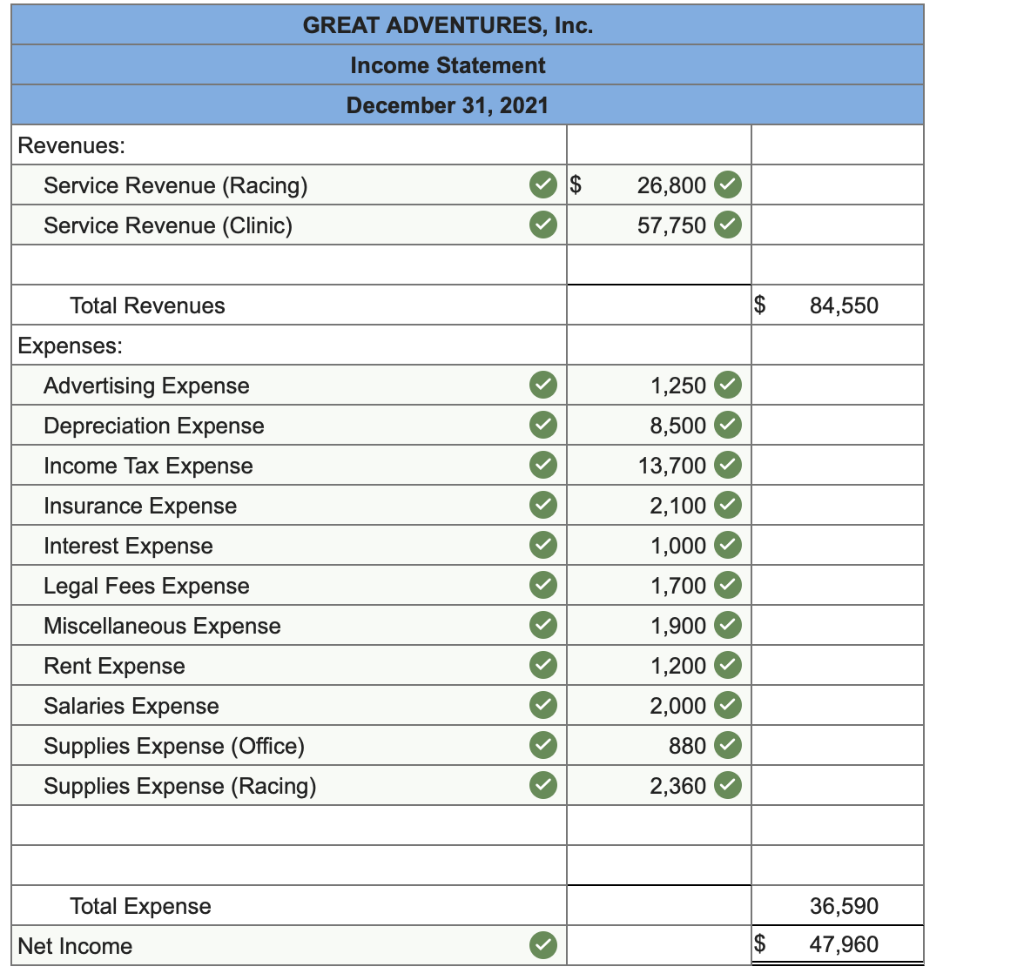

On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts. All expense accounts are then closed to the income summary account by crediting the expense accounts and debiting income summary. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet.

Closing Entry Shortcuts and Software Handling

Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings. However, if the company also wanted to keep year-to-dateinformation from month to month, a separate set of records could bekept as the company progresses through the remaining months in theyear. journal entries for bad debts accounting education For our purposes, assume that we are closing the books at theend of each month unless otherwise noted. Adjusting entries are used to modify accounts so that they’re in compliance with the accrual concept of recording income and expenses. That’s why most business owners avoid the struggle by investing in cloud accounting software instead.

The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger. Thebusiness has been operating for several years but does not have theresources for accounting software. This means you are preparing allsteps in the accounting cycle by hand. When you close the books monthly, that means you make journal entries to ensure all transactions for the month have been captured. This makes it easier to do monthly tasks like bank reconciliation, sending sales tax reports to the state, paying your suppliers, and generating customer statements.

The third entry requires Income Summary to close to the RetainedEarnings account. To get a zero balance in the Income Summaryaccount, there are guidelines to consider. All accounts can be classified as either permanent (real) ortemporary (nominal) (Figure5.3). Businesses often use professional bookkeeping services to ensure they are on track financially, are tax-season ready, and are able to continue to grow and thrive.

You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food. This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted).

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period.

Deixar Um Comentário